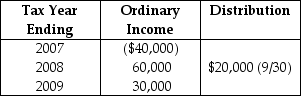

Robert Elk paid $100,000 for all of the single class of stock of Elkom Corporation,an electing S corporation,when incorporated in January,2007.Elkom's operating results and dividend distribution are as follows:

What is Elk's basis for his Elkom stock on December 31 of 2007?

What is Elk's basis for his Elkom stock on December 31 of 2007?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q3: List and discuss five advantages and five

Q13: Martha, a U.S. citizen, owns 40% of

Q21: Swamp Corporation, a calendar-year taxpayer, has been

Q40: Garret and Hans own all the stock

Q61: If losses are suspended due to the

Q67: Can loss or credit carryforwards from a

Q68: What is a permitted year?

Q81: Zebra Corporation has always been an S

Q90: Caravan Corporation has always been an S

Q96: King Corporation, an electing S corporation, is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents