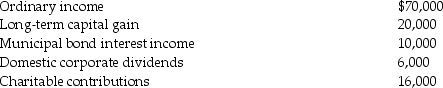

Rocky Corporation,an S corporation,reports the following results for the current year:

Rocky's AAA and accumulated E&P balances at the beginning of the year are $80,000 and $50,000,respectively.Rocky makes a $100,000 cash distribution to its sole shareholder on June 1 and a second $100,000 cash distribution on December 1.The shareholder's basis for Rocky stock on January 1 was $120,000.Discuss the tax consequences of these transactions.

Rocky's AAA and accumulated E&P balances at the beginning of the year are $80,000 and $50,000,respectively.Rocky makes a $100,000 cash distribution to its sole shareholder on June 1 and a second $100,000 cash distribution on December 1.The shareholder's basis for Rocky stock on January 1 was $120,000.Discuss the tax consequences of these transactions.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q7: Shamrock Corporation has two classes of common

Q11: VJ Corporation is to be owned equally

Q13: Martha, a U.S. citizen, owns 40% of

Q40: Garret and Hans own all the stock

Q60: Zinc Corporation is created in the current

Q67: Can loss or credit carryforwards from a

Q68: What is a permitted year?

Q82: Jeff owns 50% of an S corporation's

Q90: Caravan Corporation has always been an S

Q102: Mashburn Corporation is an S corporation that

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents