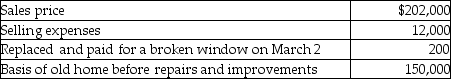

Frank,a single person age 52,sold his home this year. He had lived in the house for 10 years. He signed a contract on March 4 to sell his home and closed the sale on May 3. Based on these facts,what is the amount of his recognized gain?

Based on these facts,what is the amount of his recognized gain?

A) $0

B) $39,800

C) $40,000

D) $52,000

Correct Answer:

Verified

Q26: If there is a like-kind exchange of

Q33: Landry exchanged land with an adjusted basis

Q34: Which of the following statements is not

Q36: Jason owns a warehouse that is used

Q37: Pamela owns land for investment purposes.The land

Q53: Stephanie's building,which was used in her business,was

Q61: Ed owns a racehorse with a $600,000

Q62: Alex owns an office building which the

Q64: The building used in Manuel's business was

Q74: Ron's building,which was used in his business,was

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents