Daniel recognizes $35,000 of Sec.1231 gains and $25,000 of Sec.1231 losses during the current year.The only other Sec.1231 item was a $4,000 loss three years ago.This year,Daniel must report

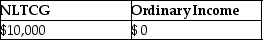

A)

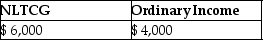

B)

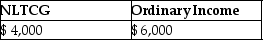

C)

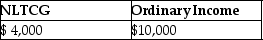

D)

Correct Answer:

Verified

Q3: During the current year,George recognizes a $30,000

Q8: During the current year,Kayla recognizes a $40,000

Q13: Why did Congress establish favorable treatment for

Q63: In addition to the normal recapture rules

Q70: Frisco Inc.,a C corporation,placed a building in

Q81: Costs of tangible personal business property which

Q82: Gain recognized on the sale or exchange

Q83: Installment sales of depreciable property which result

Q87: When gain is recognized on an involuntary

Q93: If no gain is recognized in a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents