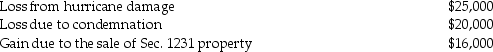

The following gains and losses pertain to Arnold's business assets that qualify as Sec.1231 property.Arnold does not have any nonrecaptured net Sec.1231 losses from previous years,and the portion of gain recaptured as ordinary income due to the depreciation recapture provisions has been eliminated.

Describe the specific tax treatment of each of these transactions.

Describe the specific tax treatment of each of these transactions.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q36: Elaine owns equipment ($23,000 basis and $15,000

Q86: Connors Corporation sold a warehouse during the

Q92: Pam owns a building used in her

Q94: The following are gains and losses recognized

Q95: Describe the tax treatment for a noncorporate

Q96: Jed sells an office building during the

Q97: Melissa acquired oil and gas properties for

Q99: An unincorporated business sold two warehouses during

Q1702: Sarah owned land with a FMV of

Q1729: What is the purpose of Sec. 1245

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents