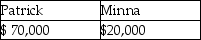

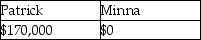

Yellow Trust must distribute 33% of its income annually to Patrick.In addition,the trustee in its discretion may distribute additional income to Minna or Patrick.In the current year,the trust has net accounting income and distributable net income of $150,000,none from tax-exempt sources.The trust makes a $50,000 mandatory distribution to Patrick and a discretionary distribution of $20,000 each to Patrick and Minna.What amounts of income do Patrick and Minna report?

A)

B)

C)

D)

Correct Answer:

Verified

Q18: Texas Trust receives $10,000 interest on U.S.

Q23: Charitable contributions made by a fiduciary

A)are limited

Q26: A trust is required to distribute 10%

Q29: Estates and trusts

A)are taxed on state and

Q34: The exemption amount for an estate is

A)$0.

B)$100.

C)$300.

D)$600.

Q40: Identify which of the following statements is

Q52: A trust that is required to distribute

Q58: Which of the following is not an

Q85: An example of income in respect to

Q89: Identify which of the following statements is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents