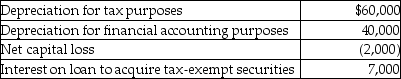

Winter Corporation's taxable income is $500,000.In addition,Winter has the following items:  What is Winter's financial accounting income?

What is Winter's financial accounting income?

A) $511,000

B) $513,000

C) $518,000

D) $520,000

Correct Answer:

Verified

Q59: Chambers Corporation is a calendar year taxpayer

Q71: Paul, who owns all the stock in

Q73: Lass Corporation reports a $25,000 net capital

Q78: Grant Corporation is not a large corporation

Q80: Bishop Corporation reports taxable income of $700,000

Q84: Identify which of the following statements is

Q84: Access Corporation,a large manufacturer,has a taxable income

Q85: Andy owns 20% of North Corporation and

Q96: Davis Corporation,a manufacturer,has taxable income of $150,000.Davis's

Q97: Identify which of the following statements is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents