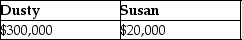

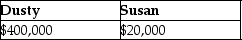

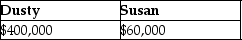

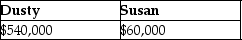

Dusty Corporation owns 90% of Palace Corporation's stock and Susan owns the remaining stock.Dusty Corporation's stock basis is $300,000 and Susan's stock basis is $20,000.Under a plan of complete liquidation,Dusty Corporation receives property with a $400,000 adjusted basis and a $540,000 FMV and Susan receives property with a $20,000 adjusted basis and a $60,000 FMV.The bases of the properties are:

A)

B)

C)

D)

Correct Answer:

Verified

Q46: Ball Corporation owns 80% of Net Corporation's

Q47: Ball Corporation owns 80% of Net Corporation's

Q58: Identify which of the following statements is

Q59: Market Corporation owns 100% of Subsidiary Corporation's

Q63: The general rule for tax attributes of

Q70: Key Corporation distributes a patent with an

Q72: Barbara owns 100 shares of Bond Corporation

Q73: Greg, a cash method of accounting taxpayer,

Q92: When a liquidating corporation pays off an

Q99: During 2013,Track Corporation distributes property to Cindy

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents