Homewood Corporation adopts a plan of liquidation on June 15 and shortly thereafter sells a parcel of land on which it realizes a $50,000 gain (excluding the effects of a $5,000 sales commission) .Homewood pays its legal counsel $2,000 to draft the plan of liquidation.The accountant fees for the liquidation are $1,000,which are also paid during the year.What is Homewood Corporation's realized gain on the sale of land and deductible liquidation expenses?

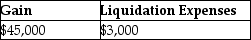

A)

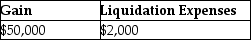

B)

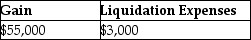

C)

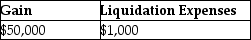

D)

Correct Answer:

Verified

Q48: Identify which of the following statements is

Q52: Sandy,a cash method of accounting taxpayer,has a

Q53: Identify which of the following statements is

Q54: Prime Corporation liquidates its 85%-owned subsidiary Bass

Q61: Lake City Corporation owns all of the

Q68: Lake City Corporation owns all the stock

Q70: Key Corporation distributes a patent with an

Q77: Hope Corporation was liquidated four years ago.

Q80: Identify which of the following statements is

Q86: Identify which of the following statements is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents