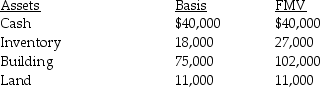

David sells his one-third partnership interest to Diana for $60,000 when his basis in the partnership interest is $48,000.On the date of sale,the partnership has no liabilities and the following assets:

The building is depreciated on a straight-line basis.What tax issues should David and Diana consider with respect to the sale transaction?

The building is depreciated on a straight-line basis.What tax issues should David and Diana consider with respect to the sale transaction?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q33: When Rachel's basis in her interest in

Q41: What is included in the definition of

Q51: Ed receives a $20,000 cash distribution from

Q68: What is the character of the gain/loss

Q92: Quinn and Pamela are equal partners in

Q97: On December 31,Kate receives a $28,000 liquidating

Q97: Rod owns a 65% interest in the

Q99: Tony sells his one-fourth interest in the

Q102: Brown Company recently has been formed as

Q108: The Principle Limited Partnership has more than

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents