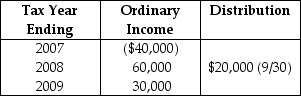

Robert Elk paid $100,000 for all of the single class of stock of Elkom Corporation,an electing S corporation,when incorporated in January,2007.Elkom's operating results and dividend distribution are as follows:

What is Elk's basis for his Elkom stock on December 31 of 2007?

What is Elk's basis for his Elkom stock on December 31 of 2007?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q3: List and discuss five advantages and five

Q11: VJ Corporation is to be owned equally

Q13: Martha, a U.S. citizen, owns 40% of

Q58: Woods Corporation has operated as a C

Q61: If losses are suspended due to the

Q67: Can loss or credit carryforwards from a

Q68: What is a permitted year?

Q82: Jeff owns 50% of an S corporation's

Q96: King Corporation, an electing S corporation, is

Q98: Rocky Corporation,an S corporation,reports the following results

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents