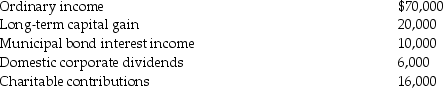

Rocky Corporation,an S corporation,reports the following results for the current year:

Rocky's AAA and accumulated E&P balances at the beginning of the year are $80,000 and $50,000,respectively.Rocky makes a $100,000 cash distribution to its sole shareholder on June 1 and a second $100,000 cash distribution on December 1.The shareholder's basis for Rocky stock on January 1 was $120,000.Discuss the tax consequences of these transactions.

Rocky's AAA and accumulated E&P balances at the beginning of the year are $80,000 and $50,000,respectively.Rocky makes a $100,000 cash distribution to its sole shareholder on June 1 and a second $100,000 cash distribution on December 1.The shareholder's basis for Rocky stock on January 1 was $120,000.Discuss the tax consequences of these transactions.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q3: List and discuss five advantages and five

Q11: VJ Corporation is to be owned equally

Q13: Martha, a U.S. citizen, owns 40% of

Q58: Woods Corporation has operated as a C

Q65: Troy owns 50% of Dot.Com, an e-commerce

Q68: What is a permitted year?

Q75: Cook's Outlet has been an S corporation

Q82: Jeff owns 50% of an S corporation's

Q96: Robert Elk paid $100,000 for all of

Q96: King Corporation, an electing S corporation, is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents