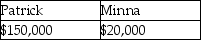

Yellow Trust must distribute 33% of its income annually to Patrick.In addition,the trustee in its discretion may distribute additional income to Minna or Patrick.In the current year,the trust has net accounting income and distributable net income of $150,000,none from tax-exempt sources.The trust makes a $50,000 mandatory distribution to Patrick and a discretionary distribution of $20,000 each to Patrick and Minna.What amounts of income do Patrick and Minna report?

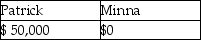

A)

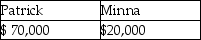

B)

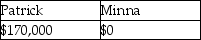

C)

D)

Correct Answer:

Verified

Q3: An inter vivos trust may be created

Q4: Identify which of the following statements is

Q11: For purposes of trust administration, the term

Q17: Revocable trusts means

A)the transferor may not demand

Q17: Identify which of the following statements is

Q24: A trust distributes 30% of its income

Q39: Identify which of the following statements is

Q40: Identify which of the following statements is

Q45: The $3,000 limitation on deducting net capital

Q104: Trusts are required to make estimated tax

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents