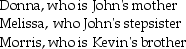

John supports Kevin,his cousin,who lived with him throughout 2013.John also supports three other individuals who do not live with him:  Assume that Donna,Melissa,Morris and Kevin each earn less than $3,900.How many personal and dependency exemptions may John claim?

Assume that Donna,Melissa,Morris and Kevin each earn less than $3,900.How many personal and dependency exemptions may John claim?

A) 2

B) 3

C) 4

D) 5

Correct Answer:

Verified

Q37: Which of the following types of itemized

Q41: Charlie is claimed as a dependent on

Q44: Anita,who is divorced,maintains a home in which

Q49: Annisa,who is 28 and single,has adjusted gross

Q52: In 2013 the standard deduction for a

Q52: Amber supports four individuals: Erin,her stepdaughter,who lives

Q56: Deborah,who is single,is claimed as a dependent

Q57: A married person who files a separate

Q57: A single taxpayer provided the following information

Q58: The regular standard deduction is available to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents