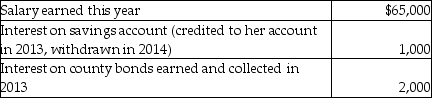

Ms.Marple's books and records for 2013 reflect the following information:  What is the amount Ms.Marple should include in her gross income in 2013?

What is the amount Ms.Marple should include in her gross income in 2013?

A) $66,000

B) $67,000

C) $68,000

D) $65,000

Correct Answer:

Verified

Q45: Alex is a calendar-year sole proprietor.He began

Q46: CT Computer Corporation,an accrual basis taxpayer,sells service

Q59: Speak Corporation,a calendar year accrual basis taxpayer,sells

Q62: Mike won $700 in a football pool.This

Q63: Becky wins a car and furniture on

Q65: Which of the following bonds do not

Q73: Social Security benefits are excluded from taxation

Q74: Income from illegal activities is taxable.

Q77: Carla redeemed EE bonds which qualify for

Q79: Amy's employer provides her with several fringe

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents