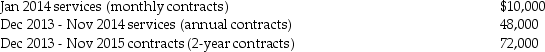

The Cable TV Company,an accrual basis taxpayer,allows its customers to pay by the month,by the year,or two years in advance.In December 2013,the company collected the following amounts applicable to future services:

If Cable TV wants to report as little income as possible for 2013,what is the amount of gross income that must be reported for 2013?

If Cable TV wants to report as little income as possible for 2013,what is the amount of gross income that must be reported for 2013?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q81: Julia,age 57,purchases an annuity for $33,600.Julia will

Q82: Under the terms of their divorce agreement,Humphrey

Q88: David,age 62,retires and receives $1,000 per month

Q97: A taxpayer had the following income and

Q100: Lily had the following income and losses

Q104: On April 1,2013,Martha,age 67,begins receiving payments of

Q106: Kevin is a single person who earns

Q112: Ellen is a single taxpayer with qualified

Q127: Gwen's marginal tax bracket is 25%.Gwen pays

Q884: Rocky owns The Palms Apartments. During the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents