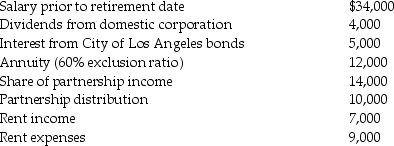

Jeannie,a single taxpayer,retired during the year,to take over the management of some rental property.She had the following items of income and expense:

What is Jeannie's adjusted gross income for the year?

What is Jeannie's adjusted gross income for the year?

Correct Answer:

Verified

Q103: During 2013,Christiana's employer withheld $1,500 from her

Q105: Gabe Corporation,an accrual-basis taxpayer that uses the

Q108: Leigh inherited $65,000 of City of New

Q111: During 2013,Robert and Cassie had $2,600 withheld

Q113: During 2013,Christiana's employer withheld $1,500 from her

Q114: Chuck Corporation began operating a new retail

Q115: During 2013,Mark's employer withheld $2,000 from his

Q117: Under the terms of a divorce agreement

Q129: Emma is the sole shareholder in Pacific

Q131: Daniel plans to invest $20,000 in either

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents