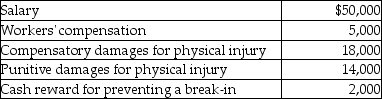

Joe Black,a police officer,was injured in the line of duty.He received the following during the current year:  What is the amount that is taxable?

What is the amount that is taxable?

A) $57,000

B) $66,000

C) $71,000

D) $84,000

Correct Answer:

Verified

Q29: The fair value of lodging cannot be

Q30: The amount of cash fringe benefits received

Q32: "No additional cost" benefits are excluded from

Q34: "Working condition fringe benefits," such as memberships

Q41: Nelda suffered a serious stroke and was

Q42: David has been diagnosed with cancer and

Q44: Cameron is the owner and beneficiary of

Q54: Hope receives an $18,500 scholarship from State

Q54: Which of the following statements regarding qualified

Q60: Sarah receives a $15,000 scholarship from City

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents