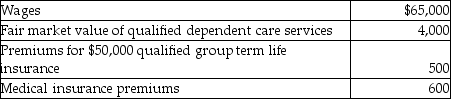

Carl filed his tax return,properly claiming the head of household filing status.Carl's employer paid or provided the following to Carl:  How much of this income should Carl report?

How much of this income should Carl report?

A) $65,000

B) $69,000

C) $69,500

D) $70,100

Correct Answer:

Verified

Q63: Fatima's employer funds child care for all

Q66: Chad and Jaqueline are married and have

Q68: For 2013,the maximum foreign-earned income exclusion is

A)$91,500.

B)$92,900.

C)$95,100.

D)$97,600.

Q70: All of the following items are excluded

Q74: Benefits covered by Section 132 which may

Q75: Miranda is not a key employee of

Q77: Michael is an employee of StayHere Hotels,Inc.in

Q78: Which one of the following fringe benefits

Q78: A department store sold a stereo to

Q80: Jan has been assigned to the Rome

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents