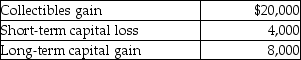

Kendrick,who has a 35% marginal tax rate,had the following results from transactions during the year:  After offsetting the STCL,what is (are) the resulting gain(s) ?

After offsetting the STCL,what is (are) the resulting gain(s) ?

A) $16,000 collectibles gain,$8,000 LTCG

B) $20,000 collectibles gain,$4,000 LTCG

C) $24,000 LTCG

D) $20,000 collectibles gain,$8,000 LTCG

Correct Answer:

Verified

Q41: Jessica owned 200 shares of OK Corporation

Q81: This year,Lauren sold several shares of stock

Q82: Coretta sold the following securities during 2013:

Q88: Darla sold an antique clock in 2013

Q90: The taxable portion of a gain from

Q91: Andrea died with an unused capital loss

Q92: Joel has four transactions involving the sale

Q96: Sanjay is single and has taxable income

Q97: Mike,a dealer in securities and calendar-year taxpayer,purchased

Q107: Amanda,whose tax rate is 33%,has NSTCL of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents