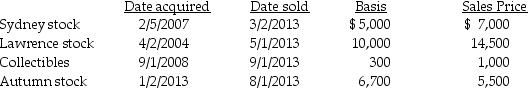

Chen had the following capital asset transactions during 2013:

What is the adjusted net capital gain or loss and the related tax due to the above transactions,assuming Chen has a 25% marginal tax rate?

What is the adjusted net capital gain or loss and the related tax due to the above transactions,assuming Chen has a 25% marginal tax rate?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q70: Emma Grace acquires three machines for $80,000,which

Q103: On July 25,2012,Marilyn gives stock with a

Q105: On January 31,2013,Mallory pays $800 for an

Q110: Jade is a single taxpayer in the

Q113: Topaz Corporation had the following income and

Q114: In the current year,ABC Corporation had the

Q120: On January 31 of this year,Jennifer pays

Q120: Mike sold the following shares of stock

Q121: Trista,a taxpayer in the 33% marginal tax

Q643: What type of property should be transferred

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents