During the current year,Lucy,who has a sole proprietorship,pays legal and accounting fees for the following:

Services rendered in resolving a federal tax deficiency

Services rendered in resolving a federal tax deficiency

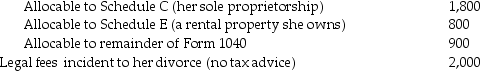

Tax return preparation fees:

Tax return preparation fees:

What amount is deductible for AGI?

What amount is deductible for AGI?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q105: Nikki is a single taxpayer who owns

Q115: During the current year,Paul,a single taxpayer,reported the

Q118: Lindsey Forbes,a detective who is single,operates a

Q124: Anita has decided to sell her stock

Q126: Brent must substantiate his travel and entertainment

Q402: Ronna is a professional golfer. In order

Q481: Diane, a successful accountant with an annual

Q483: During the current year, Jack personally uses

Q486: Explain the rules for determining whether a

Q497: Discuss tax planning considerations which a taxpayer

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents