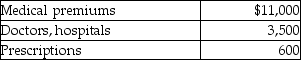

Caleb's medical expenses before reimbursement for the year include the following:  Caleb's AGI for the year is $50,000.He is single and age 58.Caleb also receives a reimbursement for medical expenses of $1,000.Caleb's deductible medical expenses that will be added to the other itemized deduction will be

Caleb's AGI for the year is $50,000.He is single and age 58.Caleb also receives a reimbursement for medical expenses of $1,000.Caleb's deductible medical expenses that will be added to the other itemized deduction will be

A) $10,350.

B) $9,100.

C) $14,500.

D) $15,100.

Correct Answer:

Verified

Q9: Leo spent $6,600 to construct an entrance

Q16: Van pays the following medical expenses this

Q31: The following taxes are deductible as itemized

Q49: In February of the current year (assume

Q52: In 2013 Sela traveled from her home

Q56: Matt paid the following taxes:

Q57: Peter is assessed $630 for street improvements

Q58: On September 1,of the current year,James,a cash-basis

Q60: Mitzi's medical expenses include the following:

Q61: Dana paid $13,000 of investment interest expense

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents