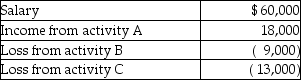

Nancy reports the following income and loss in the current year.  All three activities are passive activities with respect to Nancy.Nancy also has $21,000 of suspended losses attributable to activity C carried over from prior years.During the year,Nancy sells activity C and realizes a $15,000 taxable gain.What is Nancy's AGI as a result of these transactions?

All three activities are passive activities with respect to Nancy.Nancy also has $21,000 of suspended losses attributable to activity C carried over from prior years.During the year,Nancy sells activity C and realizes a $15,000 taxable gain.What is Nancy's AGI as a result of these transactions?

A) $50,000

B) $55,000

C) $64,000

D) $71,000

Correct Answer:

Verified

Q1: Stacy,who is married and sole shareholder of

Q5: Jamie sells investment real estate for $80,000,resulting

Q8: Juan has a casualty loss of $32,500

Q9: All of the following are true of

Q17: In 2000,Michael purchased land for $100,000.Over the

Q19: The amount realized by Matt on the

Q34: Amy,a single individual and sole shareholder of

Q55: An individual is considered to materially participate

Q58: Lewis died during the current year.Lewis owned

Q71: Which of the following is most likely

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents