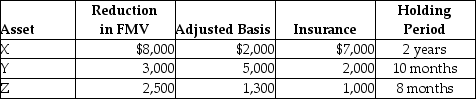

In the current year,Marcus reports the following casualty gains and losses on personal-use property.Assets X and Y are destroyed in the first casualty while Z is destroyed in a second casualty.  As a result of these losses and insurance recoveries,Marcus must report

As a result of these losses and insurance recoveries,Marcus must report

A) a net gain of $3,700.

B) a long-term gain of $4,900 on asset X; a short-term capital loss of $900 on asset Y; and a short-term capital loss of $200 on asset Z.

C) a long-term capital gain of $5,000 on asset X; a short-term capital loss of $900 on asset Y; and a short-term capital loss of $200 on asset Z.

D) a long-term capital gain of $5,000 on asset X; a short-term capital loss of $900 on asset Y; and a short-term capital loss of $300 on asset Z.

Correct Answer:

Verified

Q44: Justin has AGI of $110,000 before considering

Q50: Joseph has AGI of $170,000 before considering

Q58: Lewis died during the current year.Lewis owned

Q62: Lena owns a restaurant which was damaged

Q69: Juanita,who is single,is in an automobile accident

Q70: In February 2013,Amelia's home,which originally cost $150,000,is

Q71: Which of the following is most likely

Q72: Constance,who is single,is in an automobile accident

Q74: Jarrett owns a mountain chalet that he

Q81: Last year,Abby loaned Pat $10,000 as a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents