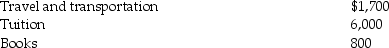

Ellie,a CPA,incurred the following deductible education expenses to maintain or improve her skills:

Ellie's AGI for the year is $60,000.

Ellie's AGI for the year is $60,000.

a.If Ellie is self-employed,what are the amount of and the nature of the deduction for these expenses?

b.If,instead,Ellie is an employee who is not reimbursed by his employer,what are the amount of and the nature of the deduction for these expenses (after limitations)?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q24: What factors are considered in determining whether

Q62: Josiah is a human resources manager of

Q64: Explain when educational expenses are deductible for

Q82: All of the following are true with

Q83: Which of the following is true about

Q113: Sarah purchased a new car at the

Q117: Tyler (age 50)and Connie (age 48)are a

Q117: Rita,a single employee with AGI of $100,000

Q120: Tia is a 52-year-old an unmarried taxpayer

Q141: Jack takes a $7,000 distribution from his

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents