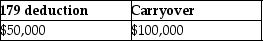

Cate purchases and places in service property costing $150,000 in 2013.She wants to elect the maximum Sec.179 deduction allowed.Her business income is $50,000.What is the amount of her allowable Sec.179 deduction and carryover,if any?

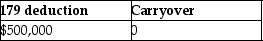

A)

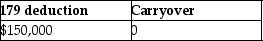

B)

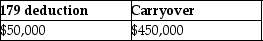

C)

D)

Correct Answer:

Verified

Q44: Which of the following statements regarding Sec.179

Q44: Harrison acquires $65,000 of 5-year property in

Q49: For real property placed in service after

Q52: In August of 2013,David acquires and places

Q55: Tanya owns an unincorporated manufacturing business.In 2013,she

Q56: In April 2013,Emma acquired a machine for

Q57: On January 3,2010,John acquired and placed into

Q61: This year Bauer Corporation incurs the following

Q77: J.R.acquires an oil and gas property interest

Q83: Intangible drilling and development costs (IDCs)may be

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents