This year,John purchased property from William by assuming an existing mortgage of $40,000 and agreed to pay an additional $60,000,plus interest,in the 3 years following the year of sale (i.e.$20,000 annual payments for three years,plus interest) .William had an adjusted basis of $44,000 in the building.What are the sales price and the contract price in this transaction?

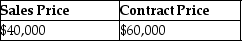

A)

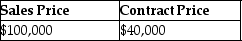

B)

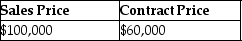

C)

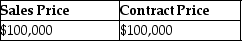

D)

Correct Answer:

Verified

Q47: Under UNICAP,all of the following overhead costs

Q53: When accounting for long-term contracts (other than

Q55: In 2013,Richard's Department Store changes its inventory

Q65: Kyle sold land on the installment basis

Q72: Which of the following conditions are required

Q80: Bergeron is a local manufacturer of off-shore

Q83: On June 11,two years ago,Gia sold land

Q85: On June 11 of last year,Derrick sold

Q87: Interest is not imputed on a gift

Q92: Sela sold a machine for $140,000.The machine

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents