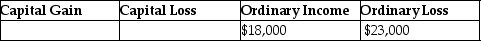

Jeremy has $18,000 of Section 1231 gains and $23,000 of Section 1231 losses.The gains and losses are characterized as

A)

B)

C)

D)

Correct Answer:

Verified

Q3: During the current year,George recognizes a $30,000

Q8: During the current year,Kayla recognizes a $40,000

Q20: During the current year,Danika recognizes a $30,000

Q65: When appreciated property is transferred at death,the

Q68: When a donee disposes of appreciated gift

Q70: Frisco Inc.,a C corporation,placed a building in

Q82: Gain recognized on the sale or exchange

Q83: Installment sales of depreciable property which result

Q87: When gain is recognized on an involuntary

Q93: If no gain is recognized in a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents