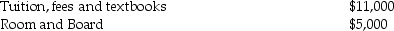

Tom and Anita are married,file a joint return with an AGI of $165,000,and have one dependent child,Tim,who is a first-time freshman in college.The following expenses are incurred and paid in 2013:

What is the maximum education credit allowed to Tom and Anita?

What is the maximum education credit allowed to Tom and Anita?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q90: Sonya started a self-employed consulting business in

Q92: If a taxpayer's AGI is greater than

Q96: Lara started a self-employed consulting business in

Q100: Tyler and Molly,who are married filing jointly

Q105: The general business credit may not exceed

Q118: Which one of the following is a

Q1631: Nick and Nicole are both 68 years

Q1657: Discuss tax- planning options available for expenses

Q1659: Describe the differences between the American Opportunity

Q1661: Discuss the tax planning techniques available to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents