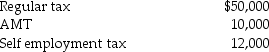

Beth and Jay project the following taxes for the current year:

In order to avoid underpayment penalties,between withholding from wages and quarterly estimated payments,Beth and Jay should pay in at least (assume the following prior year amounts):

In order to avoid underpayment penalties,between withholding from wages and quarterly estimated payments,Beth and Jay should pay in at least (assume the following prior year amounts):

a.AGI of $140,000 and total taxes of $36,000.

b.AGI of $155,000 and total taxes of $50,000.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q100: Tyler and Molly,who are married filing jointly

Q103: Tyne is single and has AGI of

Q107: Ivan has generated the following taxes and

Q108: Hawaii,Inc.,began a child care facility for its

Q117: During the year,Jim incurs $50,000 of rehabilitation

Q121: Bonjour Corp.is a U.S.-based corporation with operations

Q126: Discuss when Form 6251,Alternative Minimum Tax,must be

Q1657: Discuss tax- planning options available for expenses

Q1659: Describe the differences between the American Opportunity

Q1661: Discuss the tax planning techniques available to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents