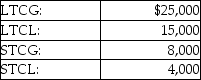

A corporation has the following capital gains and losses during the current year:  The tax result to the corporation is

The tax result to the corporation is

A) $10,000 NLTCG included in gross income and taxed at ordinary rates; $4,000 NSTCG included in gross income and taxed at reduced rates.

B) $14,000 included in gross income and taxed at reduced rates.

C) $14,000 included in gross income and taxed at ordinary rates.

D) $10,000 NLTCG is included in gross income and taxed at reduced rates; and $4,000 NSTCG included in gross income and taxed at ordinary rates.

Correct Answer:

Verified

Q8: All of the following are accurate statements

Q21: Identify which of the following statements is

Q45: All of the following business forms offer

Q50: June Corporation has the following income and

Q50: With respect to charitable contributions by corporations,

Q51: A corporation has the following capital gains

Q52: Corey Corporation reported the following results for

Q53: Jenkins Corporation has the following income and

Q59: Musketeer Corporation has the following income and

Q113: A shareholder receives a distribution from a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents