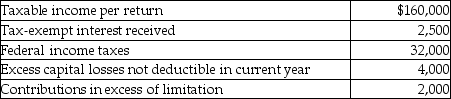

Greg Corporation,an accrual method taxpayer,had accumulated earnings and profits of $300,000 as of December 31,last year.For its current tax year,Greg's books and records reflect the following:  Based on the above,what is the amount of Greg Corporation's current earnings and profits for this year?

Based on the above,what is the amount of Greg Corporation's current earnings and profits for this year?

A) $120,500

B) $122,000

C) $124,500

D) $129,500

Correct Answer:

Verified

Q26: Dixie Corporation distributes $31,000 to its sole

Q82: A calendar-year corporation has a $75,000 current

Q87: Danielle transfers land with a $100,000 FMV

Q88: A calendar-year corporation has a $15,000 current

Q94: Blue Corporation distributes land and building having

Q97: Bob transfers assets with a $100,000 FMV

Q101: Corkie Corporation distributes $80,000 cash along with

Q114: John transfers assets with a $200,000 FMV

Q120: A corporation is owned 70% by Jones

Q127: A liquidating corporation

A)recognizes gains and losses on

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents