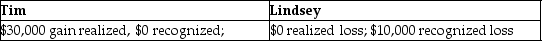

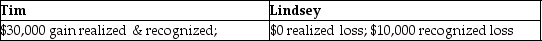

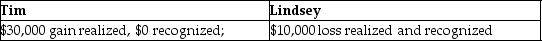

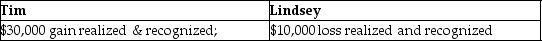

Sun Corporation makes a liquidating distribution of land with a $90,000 adjusted basis and a $100,000 FMV to shareholder Tim,who surrenders his Sun stock to the corporation.Lindsey,another shareholder,received $100,000 cash for her shares.Tim's adjusted basis in the Sun stock is $70,000.Lindsey's adjusted basis in her stock if $110,000.What is the amount of gains and or losses recognized by Tim and Lindsey as a result of these transactions?

A)

B)

C)

D)

Correct Answer:

Verified

Q50: For purposes of the accumulated earnings tax,reasonable

Q58: Indicators of possible exposure of accumulated earning

Q72: Identify which of the following statement is

Q74: Manatee Corporation,a retailer,is owned equally by twelve

Q87: A corporation distributes land worth $200,000 to

Q91: Tara transfers land with a $690,000 adjusted

Q92: Individuals Terry and Jim form TJ Corporation.Terry

Q93: Daniel transfers land with a $92,000 adjusted

Q113: Ron transfers assets with a $100,000 FMV

Q115: A corporation is owned 70% by Jones

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents