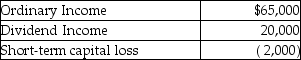

Bryan Corporation,an S corporation since its organization,is owned entirely by Mr.Bryan.The corporation uses a calendar year as its taxable year.Mr.Bryan paid $120,000 for his Bryan stock when the corporation was formed on January 1 of this year.For this year,Bryan Corporation reported the following results:  Distributions of $40,000 were made during the year.What is the basis of Mr.Bryan's stock on December 31?

Distributions of $40,000 were made during the year.What is the basis of Mr.Bryan's stock on December 31?

A) $163,000

B) $165,000

C) $203,000

D) $205,000

Correct Answer:

Verified

Q84: Worthy Corporation elected to be taxed as

Q85: Which of the following is not a

Q86: Which of the following statements regarding the

Q88: On July 1,Joseph,a 10% owner,sells his interest

Q91: On January 1 of this year (assume

Q93: Lars has a basis in his partnership

Q98: Which of the following characteristics can disqualify

Q104: Which of the following statements is correct,

Q113: An S corporation distributes land with a

Q118: An S corporation distributes land to its

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents