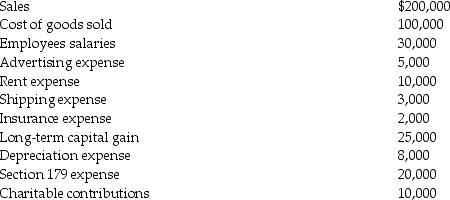

Longhorn Partnership reports the following items at the end of the current year:

What is the partnership's ordinary income? Which items are separately-stated?

What is the partnership's ordinary income? Which items are separately-stated?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q84: Stephanie owns a 25% interest in a

Q101: Mark receives a nonliquidating distribution of $10,000

Q112: Marisa has a 75% interest in the

Q126: Stephanie owns a 25% interest in a

Q146: Shelley owns a 25% interest in a

Q1127: Charlie Company is a partnership with two

Q1221: What is the primary purpose of Form

Q1223: What are special allocations of partnership items

Q1230: Why are some partnership items separately stated?

Q1278: Minna is a 50% owner of a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents