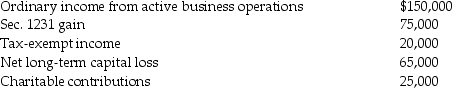

The AAA Partnership makes an election to be an Electing Large Partnership.The partnership reports the following activities:

What are the amounts reported by AAA to the partners on Schedule K-1 for inclusion on their individual tax returns?

What are the amounts reported by AAA to the partners on Schedule K-1 for inclusion on their individual tax returns?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q103: For each of the following independent cases

Q108: At the beginning of this year, Thomas

Q112: Marisa has a 75% interest in the

Q146: Shelley owns a 25% interest in a

Q1205: DAD Partnership has one corporate partner, Domino

Q1221: What is the primary purpose of Form

Q1223: What are special allocations of partnership items

Q1225: Explain the difference between expenses of organizing

Q1238: Payton and Eli form the EP Partnership

Q1278: Minna is a 50% owner of a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents