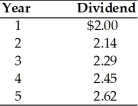

A firm has common stock with a market price of $55 per share and an expected dividend of $2.81 per share at the end of the coming year.The dividends paid on the outstanding stock over the past five years are as follows:  The cost of the firm's common stock equity is ________.

The cost of the firm's common stock equity is ________.

A) 4.1 percent

B) 5.1 percent

C) 12.1 percent

D) 15.4 percent

Correct Answer:

Verified

Q81: The cost of retained earnings is _.

A)

Q85: In comparing the constant-growth model and the

Q92: The weighted average cost of capital (WACC)reflects

Q94: Using the capital asset pricing model, the

Q96: A corporation that uses both debt and

Q97: What would be the cost of retained

Q99: A firm has common stock with a

Q100: A firm has common stock with a

Q102: The weighted average cost that reflects the

Q110: Since retained earnings are viewed as a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents