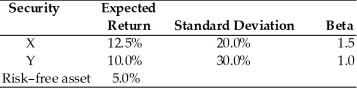

Table 8.3

Consider the following two securities X and Y.

-Using the data from Table 8.3,what is the portfolio expected return and the portfolio beta if you invest 35 percent in X,45 percent in Y,and 20 percent in the risk-free asset?

A) 9.875%,0.975

B) 10.125,1.025

C) 8.875%,0.975

D) 20.5%,1.250

Correct Answer:

Verified

Q143: What is the expected market return if

Q144: As randomly selected securities are combined to

Q144: Nicole holds three stocks in her portfolio:

Q145: Nico owns 100 shares of Stock X

Q146: Nico wants to invest all of his

Q147: Tangshan China's stock is currently selling for

Q153: Table 8.3

Consider the following two securities X

Q158: Table 8.2

You are going to invest $20,000

Q160: The difference between the return on the

Q162: The capital asset pricing model (CAPM) links

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents