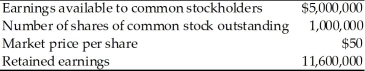

Tangshan Mining Company has released the following information.  (a)What are Tangshan Mining's current earnings per share?

(a)What are Tangshan Mining's current earnings per share?

(b)What is Tangshan Mining's current P/E ratio?

(c)Tangshan Mining wants to use half of its earnings either to pay shareholders dividends or to repurchase shares for inclusion in the firm's employee stock ownership plan.If the firm pays a cash dividend,what will be the dividend per share received by existing shareholders?

(d)Instead of paying the cash dividend,what if the firm uses half of its earnings to pay $55 per share to repurchase the shares,what will be the firm's new EPS? What should be the firm's new share price?

(e)Compare the impact of a stock dividend and stock repurchase on shareholder wealth.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q104: A shareholder receiving a stock dividend typically

Q106: Tangshan Mining has 100,000 shares outstanding and

Q117: An advantage of a _ is that

Q117: When a firm pays a stock dividend,the

Q120: The shareholder receiving a stock dividend receives

Q122: A stock split is usually taxable to

Q125: Hayley's Optical has a stockholders' equity account

Q126: The purpose of a stock split is

Q127: The purpose of a reverse stock split

Q130: Tangshan Mining has 100,000 shares outstanding and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents