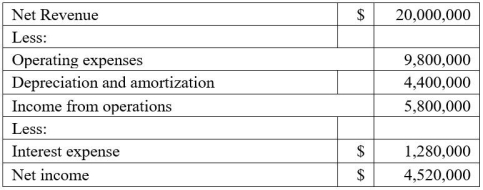

Consider the financial statements for a REIT,given above.Price multiples for comparable REITs are about 10 times current funds from operation (FFO) .What price does this suggest for the REIT's shares if 1,000,000 shares are issued?

Consider the financial statements for a REIT,given above.Price multiples for comparable REITs are about 10 times current funds from operation (FFO) .What price does this suggest for the REIT's shares if 1,000,000 shares are issued?

A) $4.52 per share

B) $45.20 per share

C) $8.92 per share

D) $89.20 per share

Correct Answer:

Verified

Q2: A REIT has an NOI of $15

Q3: The U.S.is the only country that allows

Q4: At least 95 percent of the value

Q5: REITs can sometimes capitalize rather than lease

Q6: A blended capitalization rate is an average

Q8: Real estate assets,cash,and government securities must represent

Q9: Funds from operation (FFO),is calculated by adding

Q10: Which of the following regarding private (unlisted)REITs

Q11: Because REITs are corporations,they are subject to

Q12: REITs must be passive investments with external

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents