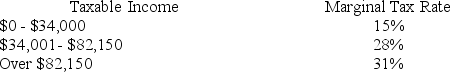

An investor who has $75,000 in taxable income purchases a building that produces another $15,000 in taxable income.What is the investor's marginal tax rate?

A) 29.50%

B) 29.57%

C) 28.00%

D) 31.00%

Correct Answer:

Verified

Q30: A property produces an after tax internal

Q31: Which of the following is FALSE regarding

Q32: A property produces a first year NOI

Q33: A property that produces a first year

Q34: The real estate industry:

A)Is highly competitive

B)Is a

Q35: A property is purchase for $15 million.Financing

Q37: Which of the following is FALSE regarding

Q38: The minimum lenders typically require for DCR

Q39: A restaurant is for sale for $200,000.It

Q40: The general investment strategy based on a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents