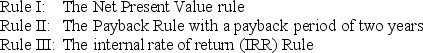

Mary is in contract negotiations with a publishing house for her new novel.She has two options.She may be paid $100,000 up front,and receive royalties that are expected to total $26,000 at the end of each of the next five years.Alternatively,she can receive $200,000 up front and no royalties.Which of the following investment rules would indicate that she should take the former deal,given a discount rate of 8%?

A) Rule I only

B) Rule III only

C) Rules II and III

D) Rules I and II

E) Rules I and III

Correct Answer:

Verified

Q62: What is the decision criteria using internal

Q64: When comparing mutually exclusive projects which have

Q64: Use the table for the question(s)below.

Consider the

Q65: What is the decision criteria while using

Q66: Use the information for the question(s)below.

The Sisyphean

Q66: Internal rate of return (IRR) can reliably

Q68: An investor is considering a project that

Q70: Use the table for the question(s)below.

Consider a

Q74: The cash flows for four projects are

Q86: What can you comment about the shape

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents