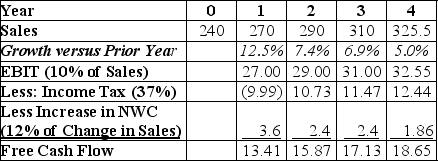

Use the table for the question(s) below.

-Banco Industries expects sales to grow at a rapid rate over the next 3 years,but settle to an industry growth rate of 5% in year 4.The spreadsheet above shows a simplified pro forma for Banco Industries.Banco Industries has a weighted average cost of capital of 12%,$50 million in cash,$60 million in debt,and 18 million shares outstanding.If Banco Industries can reduce their operating expenses so that EBIT becomes 12% of sales,by how much will their stock price increase?

A) $2.80

B) $3.36

C) $4.98

D) $8.89

E) $10.12

Correct Answer:

Verified

Q7: In the method of comparables, the known

Q14: Several methods should be used to provide

Q34: If you value a stock using a

Q92: Suppose Air Canada has a current share

Q94: Harbour Corporation pays a dividend of $2.15

Q96: Harbour Corporation pays a dividend of $2.15

Q98: Use the table for the question(s)below.

Q99: Suppose RBC has a current share price

Q100: Use the figure for the question(s)below.

Q101: Valuation models use the relationship between share

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents