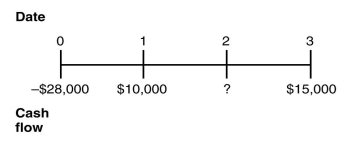

You are offered an investment opportunity that costs you $28,000,has a net present value (NPV) of $2278,lasts for three years,has interest rate of 10%,and produces the following cash flows:  The missing cash flow from year 2 is closest to:

The missing cash flow from year 2 is closest to:

A) $12,500

B) $12,000

C) $13,000

D) $10,000

E) $14,000

Correct Answer:

Verified

Q21: Trial and error is the only way

Q40: You are saving money to buy a

Q42: Joey buys a bond for $10,000 that

Q43: Dan buys a property for $250,000.He is

Q44: What is the difference between a perpetuity

Q46: The present value of an annuity that

Q47: You are considering investing in a zero-coupon

Q48: A businessman wants to buy a truck.The

Q49: The timeline below shows a $10,000 dollar

Q50: What is the internal rate of return

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents