Use the information for the question(s) below.

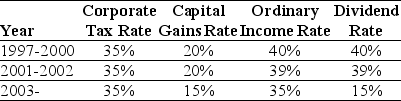

Consider the following tax rates:

-In 2006,Luther Incorporated paid a special dividend of $5 per share for the 1 million shares outstanding.If Luther has instead retained that cash permanently and invested it into Treasury bills earning 6%,then the present value (PV) of the additional taxes paid by Luther would be closest to:

A) $.35 million

B) $2.90 million

C) $1.75 million

D) $5.85 million

E) $3.25 million

Correct Answer:

Verified

Q65: In perfect capital markets, buying and selling

Q68: Malibu Mannequins is an all-equity firm with

Q69: If Luther invests the excess cash in

Q70: Fireball Furnaces is an all-equity firm with

Q71: If Luther decides to pay the dividend

Q72: Firms may retain large amounts of cash

Q75: According to the _ theory of payout

Q76: Explain the different effects on a firm's

Q77: The WTC Corporation will pay a constant

Q78: The largest proportion of investors in common

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents