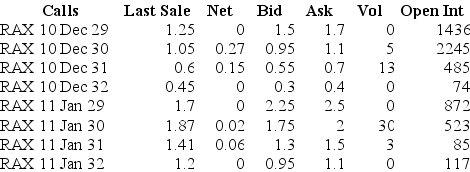

Use the table for the questions below

Consider the following information on options from the CBOE for Rackspace.

-Assume you want to sell 20 call option contracts with an exercise price closest to being at-the-money and that expires January 2011.The current price that you would receive for such a contract is:

A) $4500

B) $2600

C) $3900

D) $4000

E) $3500

Correct Answer:

Verified

Q18: When the exercise price of an option

Q19: When the exercise price of a call

Q20: The _ is the total number of

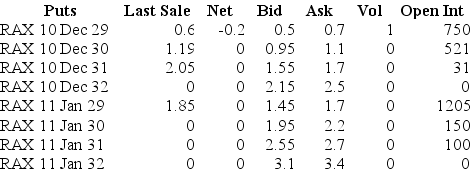

Q21: Use the table for the questions below

Consider

Q24: What is a put option?

Q24: How many of the January 2009 put

Q26: How many of the January 2009 put

Q27: Use the table for the questions below

Consider

Q28: How many of the January 2009 call

Q266: What is a call option?

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents