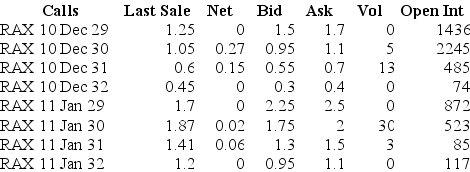

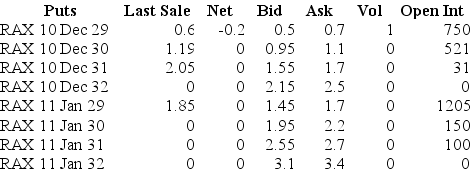

Use the table for the questions below

Consider the following information on options from the CBOE for Rackspace.

-Assume you want to sell 20 put option contracts with an exercise price closest to being at-the-money and that expires January 2011.The current price that you would receive for such a contract is:

A) $1750

B) $2000

C) $3500

D) $3900

E) $4400

Correct Answer:

Verified

Q31: When is an option in-the-money?

Q32: When is an option out-the-money?

Q33: The open interest for a January 2009

Q34: How many of the January 2009 call

Q34: What are American options?

Q37: Use the table for the question(s)below.

Consider the

Q38: The open interest for a January 2011

Q39: Using options to place a bet on

Q40: How many of the December 2010 put

Q41: Use the figure for the question(s)below.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents