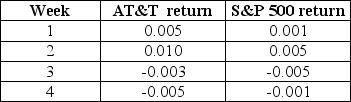

You observe that AT&T stock and the S&P 500 have the following weekly returns:  If this pattern of stock returns is typical of AT&T stock,and you calculated a beta against the S&P 500,which of the following is TRUE?

If this pattern of stock returns is typical of AT&T stock,and you calculated a beta against the S&P 500,which of the following is TRUE?

A) AT&T's beta is negative.

B) AT&T's beta is zero.

C) AT&T's beta is positive.

D) AT&T's beta is highly negative.

E) Beta cannot be calculated from this data.

Correct Answer:

Verified

Q63: The market portfolio is the portfolio of

Q64: A linear regression to estimate the relation

Q65: How does the S&P/TSX Composite index rank

Q66: You expect General Motors (GM)to have a

Q67: Air Canada stock has a standard deviation

Q69: For each 1% change in the market

Q70: You expect General Motors (GM)to have a

Q71: The S&P 500 index traditionally is a

Q72: You expect General Motors (GM)to have a

Q73: Companies that sell household products and food

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents