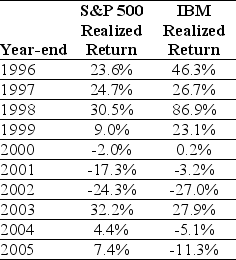

Use the table for the question(s) below.

Consider the following realized annual returns:

-The average annual return over the period 1926-2009 for the S&P 500 is 11.7%,and the standard deviation of returns is 20.5%.Based on these numbers,what is a 95% confidence interval for 2010 returns?

A) 1.5%,,22.0%

B) -8.8%,32.2%

C) -29.3%,52.7%

D) -29.3%,73.2%

E) -14.4%,26.2%

Correct Answer:

Verified

Q37: Amazon.com stock prices gave a realized return

Q38: IGM Realty had a price of $30,$30,$35,$33,and

Q39: Suppose the quarterly arithmetic average return for

Q40: The S&P TSX Composite index delivered a

Q41: The probability mass between two standard deviations

Q43: The average annual return over the period

Q44: If a stock pays dividends at the

Q47: The average annual return over the period

Q57: Which type of investment has historically had

Q59: What are the two components of realized

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents